All Categories

Featured

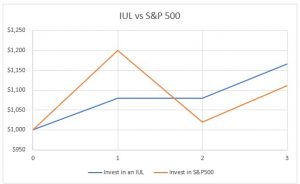

If you're mosting likely to utilize a small-cap index like the Russell 2000, you could want to pause and consider why a great index fund company, like Vanguard, doesn't have any type of funds that follow it. The factor is because it's a poor index. And also that transforming your whole plan from one index to another is barely what I would call "rebalancing - universal life crediting rate." Money value life insurance policy isn't an eye-catching asset class.

I haven't also attended to the straw man here yet, and that is the truth that it is fairly uncommon that you in fact have to pay either taxes or substantial compensations to rebalance anyhow. The majority of smart financiers rebalance as much as possible in their tax-protected accounts.

Nationwide Index Universal Life

Decumulators can do it by taking out from property classes that have succeeded. And of training course, nobody ought to be buying packed common funds, ever before. Well, I really hope posts like these help you to see via the sales techniques typically made use of by "monetary specialists." It's really regrettable that IULs don't work.

Latest Posts

Universal Life No Lapse Guarantee

Index Universal Life Insurance With Long Term Care

Universal Insurance Payment